All Categories

Featured

Table of Contents

Term life insurance coverage is a type of policy that lasts a certain length of time, called the term. You pick the size of the policy term when you initially take out your life insurance coverage.

Select your term and your quantity of cover. Select the plan that's right for you., you understand your premiums will certainly stay the very same throughout the term of the policy.

Who offers flexible Level Term Life Insurance Benefits plans?

Life insurance policy covers most scenarios of fatality, yet there will be some exclusions in the terms of the policy - Level death benefit term life insurance.

Hereafter, the policy finishes and the surviving partner is no more covered. Individuals typically get joint plans if they have outstanding monetary dedications like a home mortgage, or if they have youngsters. Joint policies are usually more affordable than solitary life insurance coverage policies. Other types of term life insurance policy are:Reducing term life insurance policy - The quantity of cover minimizes over the length of the policy.

This safeguards the investing in power of your cover quantity against inflationLife cover is an excellent point to have due to the fact that it offers economic security for your dependents if the worst occurs and you pass away. Your loved ones can additionally utilize your life insurance policy payout to spend for your funeral. Whatever they select to do, it's great assurance for you.

Level term cover is fantastic for fulfilling daily living costs such as family expenses. You can additionally use your life insurance policy advantage to cover your interest-only mortgage, payment home loan, college charges or any various other financial obligations or recurring payments. On the other hand, there are some disadvantages to degree cover, compared to other kinds of life policy.

Is there a budget-friendly Level Term Life Insurance For Families option?

Words "level" in the phrase "degree term insurance policy" means that this kind of insurance policy has a fixed costs and face quantity (death advantage) throughout the life of the policy. Put simply, when individuals speak about term life insurance policy, they normally refer to degree term life insurance policy. For the majority of individuals, it is the simplest and most economical choice of all life insurance policy types.

The word "term" right here refers to a provided number of years during which the level term life insurance policy remains energetic. Level term life insurance is one of the most preferred life insurance coverage policies that life insurance coverage service providers use to their customers as a result of its simplicity and price. It is additionally easy to contrast degree term life insurance policy quotes and obtain the very best costs.

The device is as complies with: Firstly, choose a policy, death advantage amount and policy period (or term length). Secondly, select to pay on either a regular monthly or annual basis. If your premature demise occurs within the life of the policy, your life insurance company will pay a lump sum of survivor benefit to your fixed beneficiaries.

Who offers Level Term Life Insurance Calculator?

Your degree term life insurance coverage policy runs out as soon as you come to the end of your plan's term. Choice B: Acquire a new degree term life insurance policy.

FOR FINANCIAL PROFESSIONALS We have actually developed to supply you with the most effective online experience. Your present internet browser could restrict that experience. You might be utilizing an old internet browser that's in need of support, or settings within your browser that are not suitable with our website. Please conserve on your own some disappointment, and update your internet browser in order to see our website.

How can Tax Benefits Of Level Term Life Insurance protect my family?

Currently using an upgraded internet browser and still having trouble? Please provide us a telephone call at for more aid. Your existing internet browser: Finding ...

If the plan runs out before your fatality or you live past the policy term, there is no payment. You may have the ability to renew a term plan at expiration, but the premiums will certainly be recalculated based on your age at the time of renewal. Term life is normally the the very least expensive life insurance policy readily available since it provides a survivor benefit for a restricted time and does not have a money value component like long-term insurance coverage has.

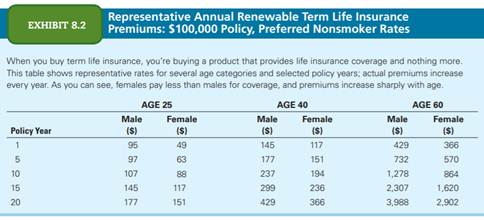

Whole Life Insurance Rates 30 $282 $247 40 $382 $352 50 $571 $498 60 $887 $782 Resource: Quotacy. Quotes are for a $500,000 irreversible life insurance coverage policy, for guys and ladies in outstanding health and wellness.

Who provides the best Compare Level Term Life Insurance?

That decreases the general threat to the insurance company compared to a long-term life policy. The decreased risk is one element that enables insurance companies to bill lower premiums. Rate of interest, the financials of the insurer, and state regulations can additionally affect costs. Generally, companies often provide far better rates at the "breakpoint" coverage degrees of $100,000, $250,000, $500,000, and $1,000,000.

He acquires a 10-year, $500,000 term life insurance coverage plan with a premium of $50 per month. If George dies within the 10-year term, the policy will pay George's recipient $500,000.

If he lives and renews the policy after 10 years, the costs will certainly be more than his initial plan because they will certainly be based upon his existing age of 40 as opposed to 30. Level death benefit term life insurance. If George is identified with an incurable health problem throughout the first policy term, he most likely will not be qualified to restore the policy when it expires

There are a number of kinds of term life insurance policy. The most effective alternative will depend upon your individual circumstances. Usually, many business supply terms ranging from 10 to 30 years, although a few offer 35- and 40-year terms. Level-premium insurance has a fixed monthly repayment for the life of the policy. Many term life insurance has a degree premium, and it's the type we have actually been referring to in most of this write-up.

Level Term Life Insurance Vs Whole Life

They might be a good option for a person who requires short-lived insurance. The insurance holder pays a taken care of, level premium for the duration of the policy.

Latest Posts

How do I compare Level Term Life Insurance Calculator plans?

Why should I have Best Value Level Term Life Insurance?

Legacy Planning