All Categories

Featured

Table of Contents

Best Company as A++ (Superior; Top group of 15). The ranking is since Aril 1, 2020 and goes through alter. MassMutual has received different rankings from various other rating firms. Haven Life And Also (And Also) is the advertising and marketing name for the And also biker, which is consisted of as component of the Haven Term policy and supplies access to additional solutions and benefits at no charge or at a price cut.

Figure out much more in this guide. If you depend upon somebody financially, you may question if they have a life insurance policy plan. Learn just how to find out.newsletter-msg-success,. newsletter-msg-error display: none;.

There are several kinds of term life insurance coverage plans. As opposed to covering you for your entire life expectancy like whole life or universal life plans, term life insurance policy only covers you for a marked duration of time. Plan terms typically range from 10 to thirty years, although much shorter and longer terms may be available.

A lot of generally, the policy expires. If you want to maintain protection, a life insurer might supply you the option to renew the policy for one more term. Or, your insurance provider may enable you to convert your term strategy to a permanent plan. If you included a return of costs cyclist to your plan, you would receive some or all of the cash you paid in costs if you have actually outlived your term.

What does Level Term Life Insurance Benefits cover?

Level term life insurance might be the most effective alternative for those who want protection for a set time period and desire their costs to stay stable over the term. This may relate to consumers worried about the affordability of life insurance policy and those that do not want to alter their fatality advantage.

That is due to the fact that term plans are not guaranteed to pay, while irreversible policies are, gave all costs are paid. Degree term life insurance policy is generally more expensive than decreasing term life insurance policy, where the fatality advantage decreases gradually. Besides the kind of policy you have, there are several other variables that aid establish the cost of life insurance: Older applicants normally have a higher death threat, so they are generally more pricey to guarantee.

On the other hand, you might have the ability to protect a less expensive life insurance coverage rate if you open up the policy when you're younger - Level premium term life insurance. Similar to advanced age, poor wellness can additionally make you a riskier (and extra pricey) prospect forever insurance policy. If the condition is well-managed, you may still be able to discover economical coverage.

Wellness and age are generally a lot more impactful costs variables than sex., may lead you to pay even more for life insurance. Risky jobs, like window cleaning or tree cutting, may likewise drive up your expense of life insurance coverage.

How much does Level Term Life Insurance Rates cost?

The initial step is to determine what you require the policy for and what your budget is (Level term life insurance calculator). Once you have a great concept of what you desire, you might want to contrast quotes and plan offerings from numerous firms. Some companies use on-line pricing estimate permanently insurance, but several require you to get in touch with a representative over the phone or in person.

One of the most popular type is now 20-year term. Most firms will not market term insurance to a candidate for a term that ends previous his/her 80th birthday. If a plan is "sustainable," that means it continues effective for an additional term or terms, as much as a defined age, even if the health and wellness of the guaranteed (or other factors) would trigger him or her to be denied if he or she got a new life insurance policy policy.

Premiums for 5-year sustainable term can be degree for 5 years, after that to a new rate reflecting the new age of the guaranteed, and so on every five years. Some longer term plans will ensure that the costs will certainly not enhance during the term; others don't make that assurance, allowing the insurance provider to elevate the rate during the policy's term.

This suggests that the policy's proprietor has the right to transform it right into a permanent sort of life insurance policy without added evidence of insurability. In the majority of kinds of term insurance coverage, including home owners and vehicle insurance policy, if you have not had an insurance claim under the plan by the time it ends, you get no refund of the costs.

Who are the cheapest Level Term Life Insurance Policy Options providers?

Some term life insurance coverage consumers have been unhappy at this result, so some insurance firms have actually produced term life with a "return of premium" attribute. The costs for the insurance policy with this attribute are commonly considerably greater than for plans without it, and they normally call for that you maintain the plan in pressure to its term otherwise you forfeit the return of premium advantage.

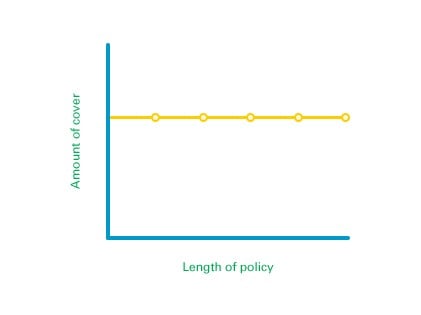

Level term life insurance costs and death advantages stay constant throughout the policy term. Level term life insurance coverage is typically more budget-friendly as it does not develop cash worth.

While the names typically are utilized reciprocally, level term protection has some important distinctions: the costs and fatality benefit remain the exact same throughout of insurance coverage. Degree term is a life insurance policy policy where the life insurance coverage costs and survivor benefit continue to be the very same for the duration of insurance coverage.

The length of your insurance coverage duration might depend on your age, where you are in your occupation and if you have any kind of dependents.

Why do I need Fixed Rate Term Life Insurance?

That commonly makes them a more budget-friendly choice forever insurance coverage. Some term policies may not keep the costs and survivor benefit the very same with time. You do not intend to mistakenly believe you're getting level term protection and after that have your survivor benefit modification later on. Many individuals get life insurance policy coverage to aid economically shield their liked ones in instance of their unexpected fatality.

Or you might have the alternative to convert your existing term protection right into a permanent policy that lasts the remainder of your life. Various life insurance policy policies have prospective benefits and disadvantages, so it is necessary to understand each prior to you choose to purchase a plan. There are a number of benefits of term life insurance policy, making it a popular option for insurance coverage.

Table of Contents

Latest Posts

Funeral Insurance Comparisons

Funeral Life

Instant Free Life Insurance Quotes

More

Latest Posts

Funeral Insurance Comparisons

Funeral Life

Instant Free Life Insurance Quotes