All Categories

Featured

Table of Contents

Maintaining all of these acronyms and insurance policy kinds right can be a headache. The adhering to table places them side-by-side so you can swiftly set apart amongst them if you get confused. Another insurance coverage kind that can settle your mortgage if you pass away is a typical life insurance policy policy

A remains in place for a set variety of years, such as 10, 20 or thirty years, and pays your beneficiaries if you were to pass away during that term. An offers protection for your whole life period and pays out when you pass away. Rather than paying your home mortgage lending institution directly the method home mortgage security insurance policy does, common life insurance coverage plans go to the beneficiaries you pick, who can then select to pay off the home loan.

One common general rule is to intend for a life insurance policy plan that will pay as much as ten times the insurance policy holder's wage amount. You may select to utilize something like the Penny technique, which includes a household's debt, revenue, mortgage and education and learning expenses to determine just how much life insurance policy is required.

There's a factor new house owners' mail boxes are typically pestered with "Last Chance!" and "Urgent! Activity Needed!" letters from mortgage protection insurance companies: Many only permit you to purchase MPI within 24 months of closing on your home mortgage. It's additionally worth noting that there are age-related limitations and thresholds enforced by virtually all insurance companies, that usually won't give older buyers as several choices, will certainly bill them extra or might refute them outright.

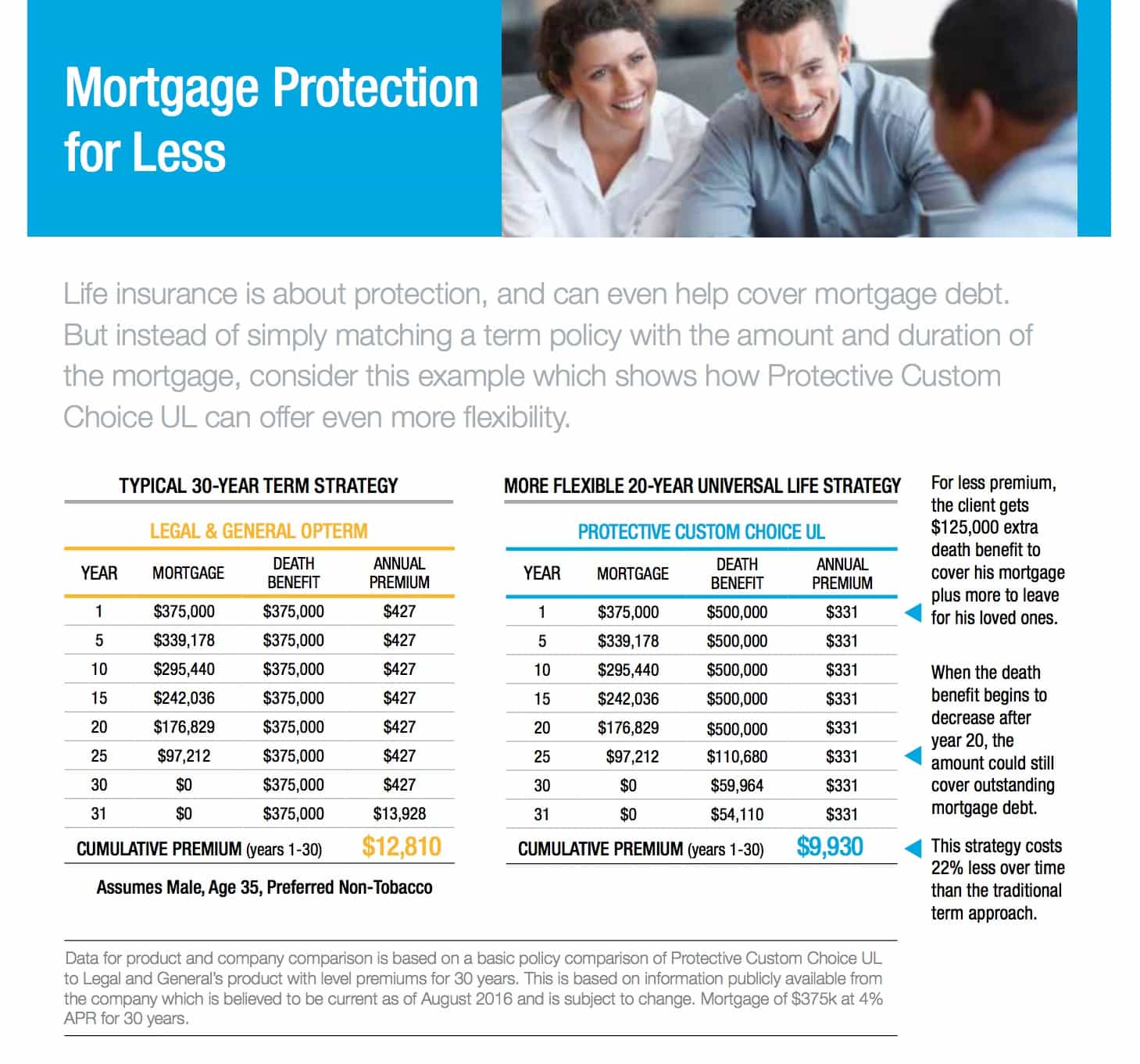

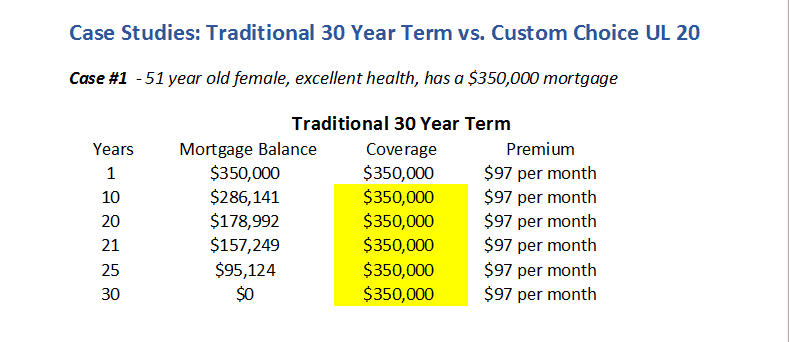

Below's just how home mortgage defense insurance policy gauges up versus standard life insurance policy. If you're able to get approved for term life insurance policy, you must stay clear of mortgage protection insurance policy (MPI). Contrasted to MPI, life insurance uses your household a cheaper and more versatile advantage that you can trust. It'll pay out the exact same amount anytime in the term a fatality occurs, and the cash can be used to cover any kind of costs your household considers necessary at that time.

In those situations, MPI can supply great peace of mind. Every home mortgage security alternative will certainly have numerous guidelines, guidelines, advantage choices and downsides that require to be considered meticulously against your precise situation.

Is Mortgage Insurance Required

A life insurance coverage plan can aid settle your home's mortgage if you were to pass away. It's one of lots of manner ins which life insurance policy may help protect your liked ones and their monetary future. One of the very best means to factor your home loan into your life insurance policy need is to chat with your insurance agent.

Rather than a one-size-fits-all life insurance policy plan, American Family members Life Insurance provider offers policies that can be created particularly to fulfill your household's requirements. Below are some of your alternatives: A term life insurance policy plan. mortgage and critical illness cover is energetic for a specific amount of time and normally provides a bigger quantity of insurance coverage at a lower cost than a permanent policy

Rather than only covering a set number of years, it can cover you for your entire life. It likewise has living advantages, such as cash value accumulation. * American Household Life Insurance Company provides various life insurance plans.

Your agent is an excellent resource to answer your inquiries. They may likewise have the ability to help you locate voids in your life insurance protection or brand-new means to save on your other insurance coverage. ***Yes. A life insurance policy beneficiary can choose to use the survivor benefit for anything - home loan insurance policy. It's an excellent means to help protect the financial future of your household if you were to die.

Life insurance policy is one way of assisting your family in settling a mortgage if you were to pass away prior to the home loan is totally paid back. No. Life insurance coverage is not obligatory, but it can be an important part helpful make certain your enjoyed ones are economically safeguarded. Life insurance policy proceeds might be utilized to aid settle a home loan, however it is not the like home loan insurance that you may be called for to have as a condition of a finance.

Mortgage Insurance That Covers Death

Life insurance coverage may help ensure your home remains in your family members by providing a survivor benefit that may aid pay down a mortgage or make important purchases if you were to pass away. Call your American Family members Insurance policy representative to review which life insurance policy policy best fits your requirements. This is a quick summary of coverage and goes through plan and/or motorcyclist terms, which might vary by state.

The words lifetime, lifelong and long-term go through plan terms. * Any type of car loans taken from your life insurance policy plan will build up interest. citimortgage life insurance. Any kind of exceptional lending equilibrium (funding plus rate of interest) will certainly be subtracted from the survivor benefit at the time of claim or from the money value at the time of surrender

** Subject to policy terms and problems. ***Discounts might differ by state and company underwriting the vehicle or house owners plan. Price cuts may not relate to all protections on a vehicle or homeowners plan. Price cuts do not put on the life plan. Policy Types: ICC18-33 (10 ), ICC18-33 (15 ), ICC18-34 (20 ), ICC18-35 (30 ), L-33 (10 )(ND), L-33 (15 )(ND), L-34 (20 )(ND), L-35 (30 )(ND), L-33 (10 )(SD), L-33 (15 )(SD), L-34 (20 )(SD), L-35 (30 )(SD), ICC18-36 (10 ), ICC18-36 (15 ), ICC18-36 (20 ), ICC18-36 (30 ), L-36 (10 )(ND), L-36 (15 )(ND), L-36 (20 )(ND), L-36 (30 )(ND), L-36 (10 )(SD), L-36 (15 )(SD), L-36 (20 )(SD), L-36 (30 )(SD), ICC17-225 WL, L-225 (ND) WL, L-225 WL, ICC17-227 WL, L-227 (ND) WL, L-227 WL, ICC17-223 WL, L-223 (ND) WL, L-223 WL, ICC17-224 WL, L-224 (ND) WL, L-224 WL, ICC17-228 WL, L-228 (ND) WL, L-228 WL, ICC21, L141, MS 01 22, L141, ND 02 22, L141, SD 02 22.

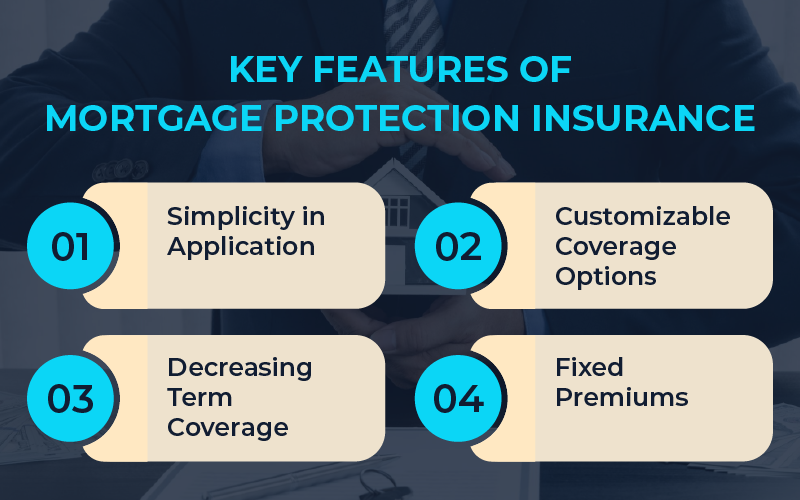

Mortgage security insurance (MPI) is a various kind of secure that might be practical if you're unable to settle your home mortgage. Home loan security insurance coverage is an insurance policy that pays off the rest of your home loan if you pass away or if you become handicapped and can not function.

Like PMI, MIP safeguards the loan provider, not you. Unlike PMI, you'll pay MIP for the period of the finance term. Both PMI and MIP are called for insurance coverage protections. An MPI plan is entirely optional. The amount you'll pay for home loan protection insurance depends upon a selection of aspects, including the insurer and the present balance of your home mortgage.

Still, there are pros and disadvantages: A lot of MPI plans are issued on a "guaranteed acceptance" basis. That can be useful if you have a health and wellness problem and pay high prices for life insurance or struggle to get protection. for mortgage insurance. An MPI policy can offer you and your family members with a feeling of safety

Legal And General Mortgage Payment Protection

It can additionally be helpful for individuals who do not get or can not afford a conventional life insurance policy policy. You can choose whether you require mortgage defense insurance policy and for how much time you need it. The terms generally vary from 10 to thirty years. You may want your home loan security insurance term to be enclose length to how much time you have delegated settle your home mortgage You can cancel a home loan defense insurance plan.

Table of Contents

Latest Posts

Funeral Insurance Comparisons

Funeral Life

Instant Free Life Insurance Quotes

More

Latest Posts

Funeral Insurance Comparisons

Funeral Life

Instant Free Life Insurance Quotes